Contractors: Get Your Books

Tax-Ready Before January —

3-Day QuickBooks Cleanup

for Just $147

I’ll clean up your QuickBooks and make it tax-ready in just

3 business days — so you can avoid IRS headaches and

start 2026 with clean, accurate numbers

Stop guessing where your money went on every job

Clean, tax-ready books before the year ends

Identify missed deductions & write-offs

Know which jobs are profitable (and which aren’t)

Enter tax season with confidence instead of fear

Tax Season Is Weeks Away —

Don’t Hand Your Preparer

a Pile of Messy Books

Most contractors don’t realize this:

the closer you get to January, the more expensive cleanup becomes.

December is your last chance to get your books cleaned fast and affordably.

I only take 2–3 cleanup clients per week to guarantee quality.

If your books are behind or messy, now is the time to fix it.

This 3-Day Cleanup Is Designed for:

General contractors

Roofers

Plumbers

Electricians

Painters

Landscapers

Concrete contractors

Handymen

HVAC techs

Any tradesman tired of messy books

What I Do for You in the 3-Day Cleanup

In just 3 business days, I’ll clean up your most recent months, fix your categories, correct your income, and give you contractor-friendly reports that make sense.

Included in the $147 Cleanup:

Up to 3 months of cleanup

Up to 750 total transactions

QuickBooks Online only

1 business checking + 1 credit card

Contractor-friendly Chart of Accounts optimization

Fixing recent “uncategorized” transactions

Reconciling recent statements

Correcting duplicate deposits & errors

Fixing income categorization

Job-friendly Profit & Loss + Balance Sheet

“Where’s My Money Going?” summary

What the $147 Cleanup Does Not Include

To be upfront and protect both of us, the 3-Day Cleanup does NOT include:

6–12+ months of cleanup

Multi-year cleanups (2–5 years)

Payroll corrections

Sales tax corrections

Migration from Desktop to Online

More than 2 business accounts

More than 750 transactions

Fixing historical errors older than 90 days

1099 preparation

Bookkeeping catch-up for all of 2025

Full reconstruction of books

If your books are older than 3 months or severely messy, don’t worry - I can still help.

You’ll simply be upgraded to the Full Cleanup Package, and I’ll give you the price before any work begins.

Need More Than 3 Months of Cleanup?

You’ll Get A Clear, Fair Quote Before I Begin.

If your books go deeper than 3 months, I’ll review your intake form and let you know if you need:

6-Month Cleanup: $397–$597

12-Month Cleanup: $747–$1,097

2 Years: Starting at $1,497

3+ Years: Custom quote

No surprises. No pressure.

I’ll tell you exactly what needs fixing and what it will cost — and you decide from there.

Bonus: Your

“Where’s My Money Going?”

Report

You’ll also receive a simple written summary showing:

Where money is leaking

Which expenses should be tax-deductible

Whether you’re ahead or behind for taxes

Simple next steps to stay organized going forward

This alone is worth the price.

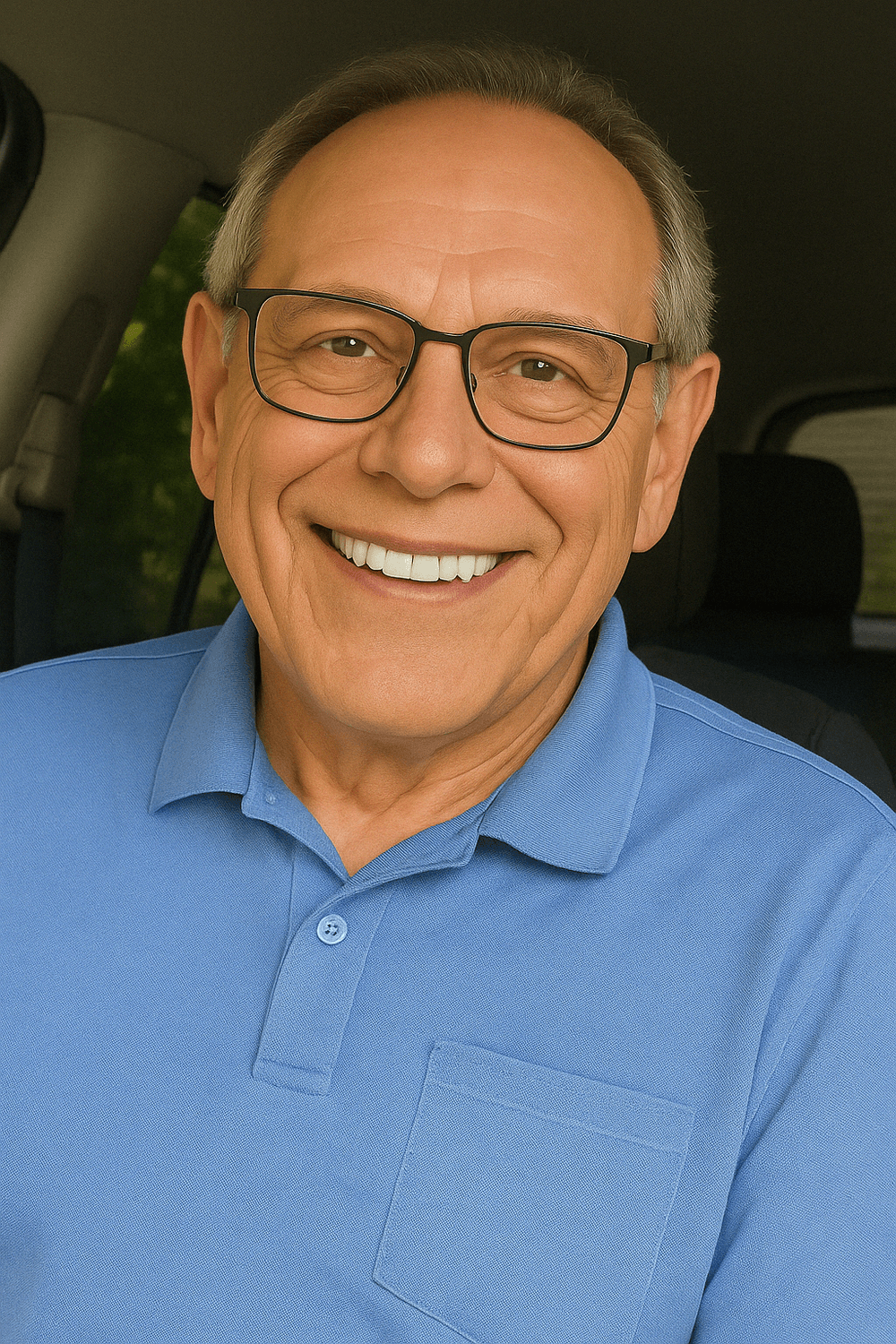

Who’s Doing Your Cleanup?

Hi, I’m Roy Shipley, owner of Shipley Bookkeeping Solutions here in Jacksonville, NC.

I’m a Navy veteran and bookkeeper specializing in construction and trades.

If you want someone who speaks “contractor” instead of “accountant,” you’re in the right place.

How the 3-Day Cleanup Works

Step 1 — Complete the Intake Form

Takes 3–5 minutes. I review your details and confirm your cleanup is within the $147 scope.

Step 2 — You Receive a Simple Invoice

Once I confirm fit, I email you a secure invoice for $147.

(No surprises and no auto-billing — you stay in full control.)

Step 3 — You Connect QuickBooks Online

You add me as an accountant user. You keep full access and can remove me anytime.

Step 4 — Cleanup Completed in 3 Business Days

I clean your books, organize your transactions, fix your income data, and deliver contractor-friendly reports.

FAQ

Q: Is $147 really all I pay?

A: Yes — as long as you fall within the included scope (up to 3 months, up to 750 transactions).

Q: What if my books are really bad?

A: If you need more than 3 months, I’ll tell you upfront and give you a Full Cleanup quote.

Q: Do I have to sign up for monthly bookkeeping after?

A: No. This is a standalone service.

Q: How do you access QuickBooks securely?

A: You add me as an accountant user. You keep full control.

Q: What type of businesses do you specialize in?

A: General contractors, roofers, plumbers, electricians, handymen, and all trades.

Only 2–3 Cleanup Spots Open Per Week (December Fills Up Fast)

If you want to go into tax season with clean books — without stress — now is the best time.

Get your books cleaned up, tax-ready, and organized in just 3 days.

Leave your email below and we'll reach out soon!

We HATE spam. Your email address is 100% secure